#04 | REE’s market perspectives

By: Wojciech Mikołajczak (Łukasiewicz Research Network – Institute of Non-Ferrous Metals)

As the energy and digital transformations unfold, demand for rare earth elements (REE) is

expected to increase rapidly. According to the U.S. Geological Survey, each electric motor

typically requires about 30 g of dysprosium and 200 grams of neodymium. According to the

International Energy Agency, the expected increase in EV production is forecast to boost

dysprosium and neodymium demand for EV’s alone from 360 and 1,000 tons in 2017, up to

13 000 and 40 000 tons by 2030 respectively. For comparison, a single 3 MW direct drive

wind turbine requires almost 2 tons of REE magnets and the wind turbine market is expected

to account for approximately 30 % of the global growth from 2015 to 2025.

Despite the name, REEs are plentiful in many parts of the world but mining and extracting

them is extremely complex and costly. Global production of REE doubled between 2010 and

2022: from 133 000 to 300 000 tons of processed REE oxides (REO’s). Considering most of

the currently operating sites to be open pit mines, it also severely impact environment. China

represents the largest REEs producer worldwide with nearly 210 000 tons of REO equivalents

in 2022 and Bayan Obo remains currently the largest exploited deposit. Since 2015, serious attempts have been to consolidate China’s REE industry backed by government financial support,

Following a temporary shutdown of the Mountain Pass facility in 2016 and 2017, the United

States is again the world’s second-largest REEs producer (38 000 tons in 2020). Notably,

refining and final processing take place in Asia. The United States is the world’s with an

output of about one-fifth the volume of China. Australia is currently the fourth-largest

producer with 17 000 tons REO in 2020 (7 %) after Myanmar (Birma) with 30 000 tons REO

(12.5 %). At Mt Weld mine, Australia’s richest deposit, during the initial campaign in 2008,

773 300 tons of ore with an average grade of 15.4 % were mined – that means over 650 000

tons of overburden material. It is worth mentioning, that ore concentrate was processed at Lynas

plant located in Malaysia.

Until recently, Europe relied solely on external supply chains. Most significant reported

Europe’s REE deposit was unveiled earlier in 2023 by LKAB. Situated northeast of the Kiirunavaara mine (Sweden), Per Geijer holds a mineral resource of 734 million tons of iron

ore and over 1.3 million tons of REOs, 25% more than initially estimated. Although total REE

content is as low as 0,18 %, it is expected to be profitable from the iron-ore production alone

and phosphorous by-products will contribute to the agricultural self-sustainability of the EU. To

ensure the construction of the first REE separation factory in Herøya, a round of financing

(equivalent to 1 billion Euro) has already been completed. The factory is expected to be

operational by the second half of 2024, with plans for a second factory in 2026 and

an additional circular industrial park in Luleå in 2027.

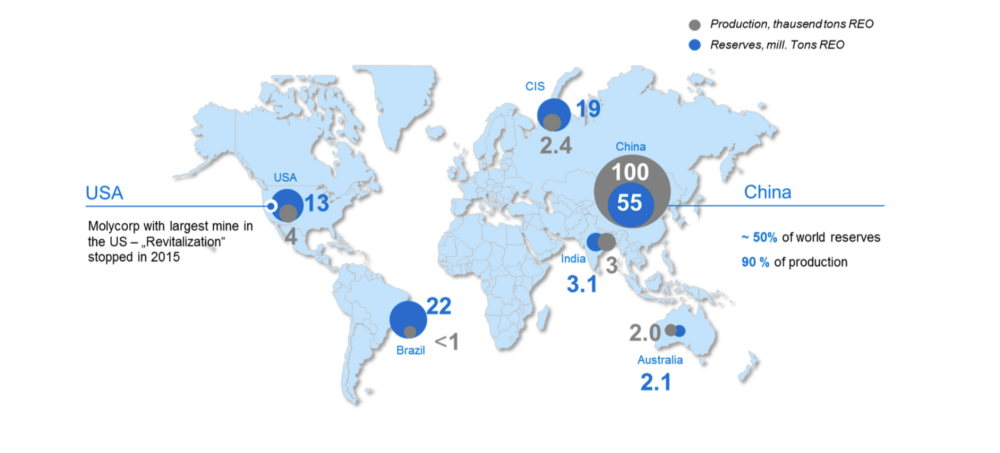

Figure 1 Overview of reserves and mining potential of REE as of 2014

More news

Discover the results of REECOVERY in its final video

REECOVERY has published its final video, in which you will be able to learn about the REECOVERY solution and discover... View Article

REECOVERY comes to an end after succeeding in recovering critical raw materials from water in the mining industry

The European REECOVERY project, which over three years has developed and validated a system for recovering critical raw materials such as... View Article

New papers published in the context of the REECOVERY project

Alexandra Roa, PhD Student at UPC, together with Julio López and Jose Luis Cortina, Researcher and Chemical Engineering Professor at... View Article